Trade Operations

- Overview:

The main function of the Trading operations department is facilitating trade between members via Authorized Representative who are employed by the members. The Trading operation is proactive in:

- Managing incoming orders

- Managing trading sessions

- Executing trades

- Recording of the trade detail

- Disseminating of the trade price

- Reconciliation of trade at the end of the each trading session

The main actors involved in the trading operations are:

- Authorized Representatives - Member employees who handle all incoming orders and execute them

- Session supervisor who is in charge of the Floor,

- Floor Manager

The Trading operations department starts with the member desk where member’s employees take order from clients. The Exchange provides each member will have desk area where orders will be received; this may also be done anywhere where there is internet connection. All incoming orders will be either through electronic system or phone. The orders received have to be properly recorded by the member.

Once orders are received, it will be forwarded to the member’s AR who will execute the order via open outcry system. The buying and selling AR’s will then enter in their trade application and will be submitted to the exchange server. The counter party will be required to confirm and after confirmation, the trade will be approved. At the end of each trading session AR will be receiving a report of their individual trades and will be expected to reconcile and check each trade to make sure all information is correct.

- Types of Orders

Each client is to define what type of order he wishes to place on the platform, the exchange system provides for two types of orders to both Selling client and buying Client

- Market Order:

Is a buy or sell order to be executed immediately at current market prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are therefore used when certainty of execution is a priority over price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time.

- Limit Order:

Is an order to buy a commodity contract at no more than a specific price, or to sell a contract at no less than a specific price. This gives the trader (client) control over the price at which the trade is executed; however, the order may never be executed. Limit orders are used when the trader wishes to control price rather than certainty of execution.E.g.: A buy limit order can only be executed at the limit price or lower (Buy at Mwk70 or less in all warehouses).E.g.: A sell limit order can only be executed at limit price or higher (Sell at Mwk65 or higher).

- Placing an Order

Clients (buyers or sellers) can place orders in the system to their respective members in a number of ways

- By using client Log In to access the system’s order entry

- Filling in a sale order form at the exchange or warehouse, authorizing the warehouse staff to place the order on your behalf.

- Informing your member to place and execute the order on your behalf.

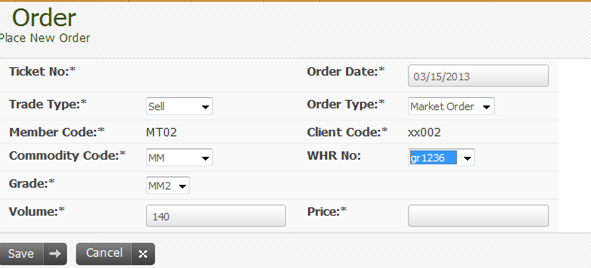

Here is a screen shot of Order management tool on AHCX system, physical order forms annexed

- Trading Session

Once an order is placed the member or authorized representative (AR) is to execute this order in a relevant trading session using open outcry system to match orders with respective AR’s. Specific training is given to AR’s to learn how to executive these orders.

Here is a screen shot of system order match on an AR’s hand held device.

- Price Limits

All contract specifications have price limit filter in place as a risk management mechanism. The price limit is an increment by prices of a commodity at a particular location may go up or down in any one day relative to yesterday’s average closing price. All posted bids or offers of each contract shall be within the allowed daily price limit, as specified in each contract.

E.g.: If yesterday’s average closing price for soya beans was Mwk100 in Kasungu at a 5% limit price filter. Today’s limit price will be not less than Mwk95 and not more than Mwk105, hence all trades will be within these limits. The exchange reserves the right to alter the limit filter and all members will be notified in writing prior to commencement of relevant trading session.

- Odd Lot Trading

The Exchange will from time to time schedule odd lot trading session, thus commodities that do not meet minimum lot for standard contract specification can be sold or bought during such sessions. Such sessions may be limited to Once a Week or dependent on Odd lot volumes.

- Re-trading of Commodities

Commodity bought on the platform can be re traded on the platform after successful application to the exchange to allow the new warehouse receipt to be traded before it is collected.

- Floor Operations

- Presentation on the floorThe Member or his authorized representative should be personally present on the exchange trading floor prior to opening of the trade session in which one wishes to trade. The Member or Authorized representatives must wear their ID at all times.

- Binding contractsAll offers are binding upon the first member making and his counterpart Member accepting such bid or offer or part of such bid or offer at the price named by the bidding or offering Member.

- Opening Call for Trading SessionsThere shall be one (1) opening call at the start of each trading session according to the session schedule announced publicly by the Exchange.

- Closing Calls for Trading SessionsThe three (3) minute period prior to the closing of trading shall be deemed the closing period for each trading session. A first closing call shall be given by the Trading Floor Supervisor at commencement of the closing period and a final closing call at the close of the trading session.

- Market Order: